June 2020 Market Trend Report

By Matrixport Research

Summary

-

BTC Price Trend: Based on the 5 key indicators and data as of 30 June, there is no clear trend in BTC short-term price movement.

-

Market Trends: In June, the main focus of the market was on DeFi as DeFi continued to make rapid progress. With Compound and Balancer releasing their tokens through “Borrowing Mining” and “Liquidity Mining” respectively, and the rapid price appreciation of the tokens in the secondary market, DeFi has been in the limelight in June. While the new economic model of DeFi is definitely worth noting, investors should also be wary of the following risks: 1) Large amounts of COMP and BAL have yet to be mined or unlocked, therefore there is only a limited amount of tokens in circulation, which can be easily manipulated; 2) Although DeFi has reduced centralization risks to a certain extent, it contains other risks such as flaws in smart contracts. This is also shown in the recent DeFi security incident.

-

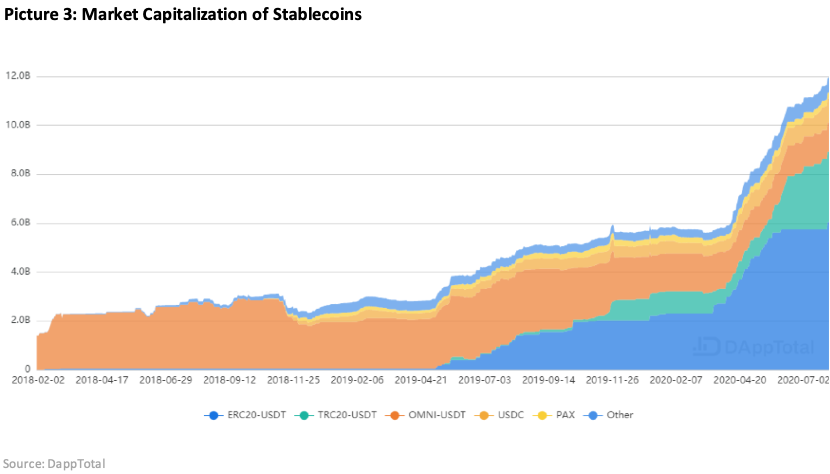

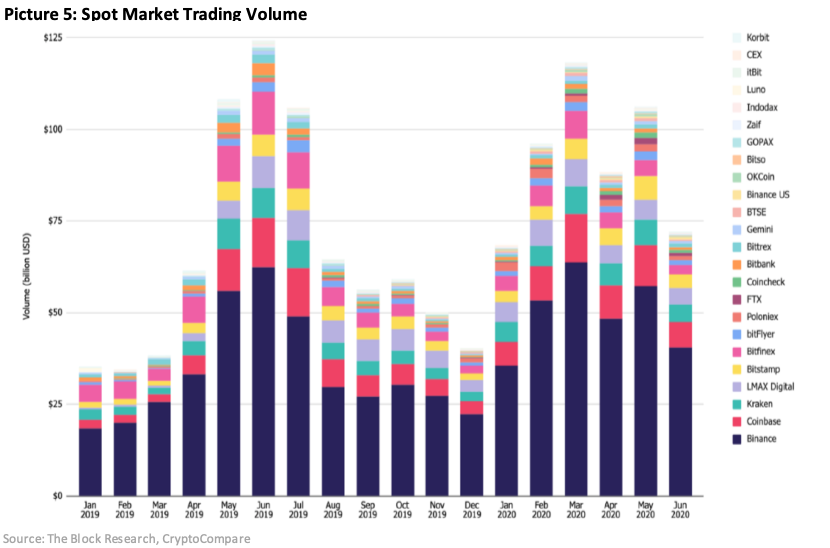

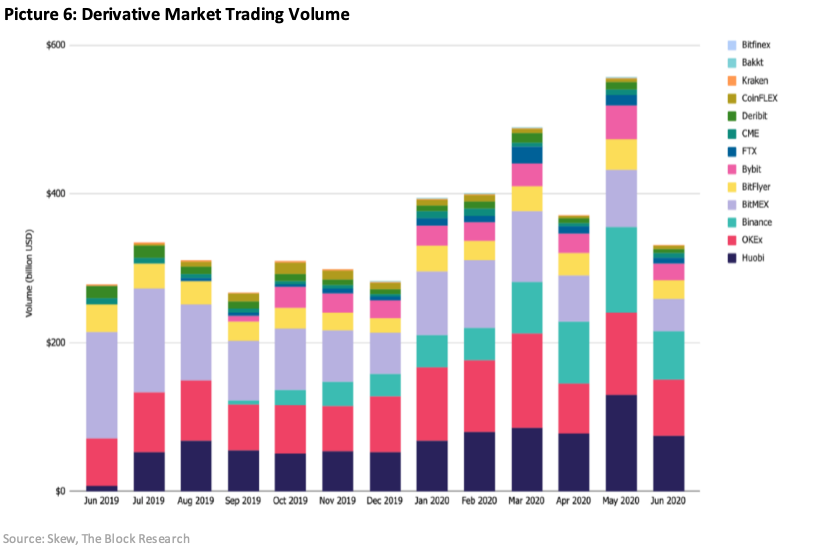

Abnormal Activity Tracker: Distribution of stablecoins have continually increased in the last 3 months, with its total market capitalization almost doubling, although growth rate has slowed in June. Although stablecoins continue to grow, the level of activity in the market has been dropping. Coupled with the decreasing volatility, the trading volumes in the spot and derivative markets have plunged in June.

BTC Price Trend

Based on data as of 30 June and the five indicators illustrated below, BTC price has no clear short-term trend. In general:

-

NVTS is a short-medium term bull/bear indicator. Current NVTS value is 85, on the slightly higher end of the scale, however it is insufficient to determine that BTC price is overvalued;

-

MVRV is a short-medium term bull/bear indicator. Curremt MVRV valus is 1.57, on the slightly higher end of the scale;

-

Mayer Multiple is currently 1.09, and has been around 1 for a long time without showing an obvious trend;

-

Bitcoin Difficulty Ribbon is a short-term buying indicator, Bitcoin Difficulty Ribbon is currently compressing. However, considering the impact of halving and wet period, the index is not considered this time;

-

During the timeframe of this report, funding rate has not shown any abnormality, therefore no short-term price signals are provided.

Market Trends

In the recent survey published on 9 June, Fidelity Investments spoke to 774 institutions based in US and in Europe, and the results showed that 36% of the respondents said they have invested in digital assets or related derivatives products. What noteworthy is that in 2019 only 22% of the institutions owned digital assets.

With the spread of Covid-19 pandemic globally and sustained global economic downturn, many countries have adopted interest rate cuts or negative interest rate policies to stimulate the economy. With the backdrop of such economic conditions, it is likely that institutional investors will continue to increase their interest in digital assets. In addition, the quality of service provided for institutional clients is also improving, these improvements include the introduction of custody and prime brokerage services, as well as the development of the derivatives market, all of which make it simpler for institutional investors to enter the digital asset market.

On 11 June, Coinbase announced that it is evaluating 18 different tokens to onboard to its platform. The tokens under consideration include Aave, Aragon, Arweave, Bancor, COMP, DigiByte, Horizen, Livepeer, NuCypher, Numeraire, KEEP Network, Origin Protocol, Ren, Render Network, Siacoin, SKALE Network, Synthetix and VeChain.

Follow-ups:

On 15 June, Compound, a decentralized finance protocol, has started to allocate its governance token COMP. There will be 10 million tokens in total, where shareholders of Compound Labs will receive 23.96% of the tokens. The co-founders and Compound team will receive 22.26% of the tokens subjected to a 4 years vesting schedule, and 3.73% will be allocated for future hires. 42.30% of the tokens are put into a “reservoir contract” which will be unlocked through “Borrowing Mining” mechanism while the remaining 7.75% will be reserved for further governance rewards.

On 24 June, Balancer, a decentralized exchange, launched its governance token BAL. The total maximum supply of BAL is capped at 100 million token, with the initial distribution being 35.4 million token. 25 million of BAL tokens are assigned to the founding team, share options, advisors and investors. 5 million BAL tokens are assigned for the Balancer Ecosystem Fund, where it be deployed to attract and incentivize strategic partners. Another 5 million is for the Fundraising Fund, where it will use for future fundraising rounds to support growth. 435 thousand was minted for liquidity providers of the first 3 weeks of “Liquidity Mining”. Subsequently, 145 thousand tokens will be minted weekly for liquidity providers.

On 26 June, Coinbase officially onboard Compound (COMP) on its platform. Users can trade, send, receive or store COMP. With the exception of the State of New York, Coinbase will provide support for all users for COMP.

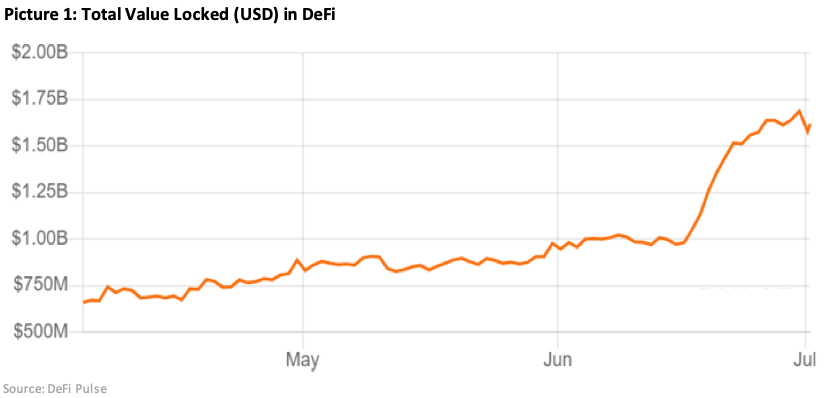

Among the tokens evaluated by Coinbase, around half are related to DeFi, Recently, the DeFi ecosystem has experienced strong growth. As of 30 June, based on DeFiMarketCap figures, market capitalization for the top 100 DeFi tokens accounts for US$6.17b. Of which, COMP token accounts for US$2.14b. In addition, based on figures tabulated by DeFi Pulse, the total value of locked assets on the DeFi ecosystem hit a historical high, reaching US$1.69b, with a 72.95% growth rate in June.

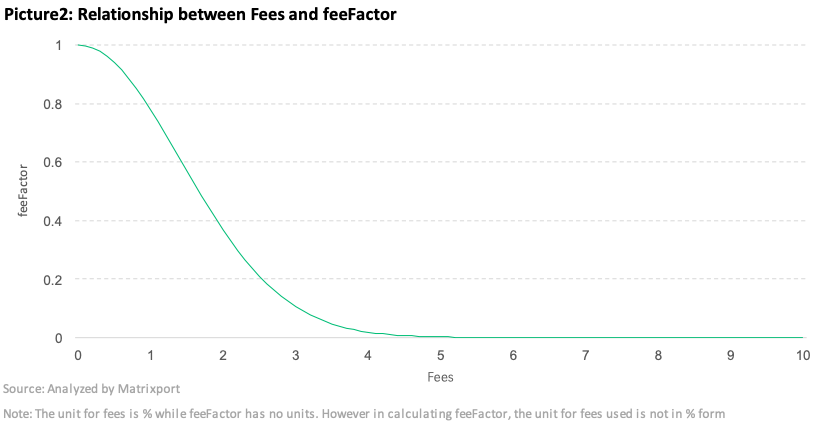

*Compound’s “Borrowing Mining” and Balancer’s “Liquidity Mining” are the key factors behind DeFi’s rapid growth. “Borrowing Mining” means that investors can receive COMP rewards when they transact on Compound. For every Ethereum block, 0.50 COMP will be distributed across the different token market (ETH. DAI etc.), proportional to the interest being accrued in the market. Within each market, half of the COMP is allocated to suppliers with the other half going to borrowers. “Liquidity Mining” is where investors provide money to the Balancer liquidity pool, and in return the investor receives a portion of the daily amount of BAL reward. The ratio is based on the liquidity each investor contributed relative to the total liquidity on Balancer, with each liquidity pool measured in its USD value. This ratio has taken in account the feeFactor which adjust the rewards: *

feeFactor=e^(-〖fee/2〗^2 ) (fee:Transaction fees,different accounts have different fees)

Unlike the previous DeFi tokens, COMP and BAL holders have governance rights but no profit sharing mechanism. Even if Compound and Balancer platform earn profits, they will not distribute any profits to token holders or buy and burn COMP and BAL.

As of 30 June 2020, the price of COMP token is US$215, BAL token is US$10.40. Based on total supply, both COMP and BAL’s market capitalizations are over US$1b, however, it is important to know that a large amount of COMP and BAL have not been mined or unlocked. There is only a limited amount of COMP and BAL in circulation, prices can be easily manipulated, therefore investors should exercise caution.

On 21 June, MultiCoin Capital analyst Tony Sheng identified five risk that investors trying to seek high stablecoin yields on DeFi are facing: 1) Smart contract vulnerability in the lending protocol; 2) Smart contract vulnerability in the underlying asset, whether that’s USD Coin, Tether’s USDT, or an altcoin; 3) A liquidation event that results in lenders losing their cryptocurrency. Such liquidations can be triggered by large swings in the price of Ethereum or other cryptocurrencies; 4) Failure in the economic design of a protocol, which can be caused by misaligned incentives; 5) User error. In addition, he added that DeFi’s risk are compounded as this segment of the Ethereum ecosystem is interconnected, a small mistake or collapse in a protocol could have negative effects for the entire space.

Follow-ups:

On 28 June, based on the news reported by DeFi website defiprime, Balancer suffered FlashLoan attacks on its previous two liquidity pools, a total of US$500k was lost.

Certik recounted the attack:

Phase 1: Attacker used WETH to buy large quantity STA tokens on Balancer, causing the price of STA rise sharply; Phase 2: The attacker used the minimum amount of STA (a value of 1e-18) to continuously repurchase WETH, resulting in minimum amount of STA gets burned during the transaction rather than transferred into the Balancer pool. The attacker takes advantage of the functionality and uses the internal function gulp () of the Balancer to lock the number of STAs, thus controlling the price of STA to WETH. The buy-back operation was repeated several times until the WETH in the Balancer is drained. Phase 3: Repays dYdX flash loan and exits the market.

Although DeFi reduced the risks associated to centralization to a certain extent, it does not mean that it is risk-free. When chasing high profits, investors should take note of the new associated risk of DeFi.

On 23 June, Coinbase reported that payment giant PayPal and its subsidiary Venmo (PayPal’s mobile payment service subsidiary) plan to roll out direct sales of digital assets to 325 million users in the next 3 months.

Abnormal Activity Tracker

At the moment, the total market capitalization of stablecoins is US$12b, with an appreciation of 100% in the last 3 months. Although the market capitalization continues to grow, the growth rate has slowed in June when compared to April and May.

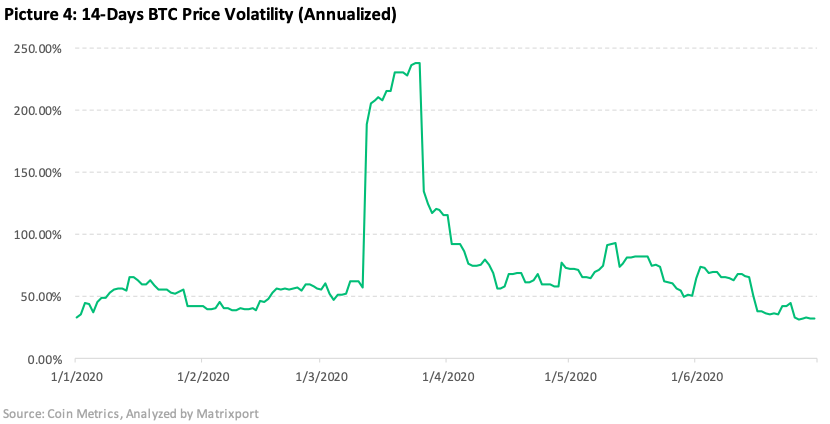

Since the “312” market collapse, volatility of BTC has continued to drop. As of 30 June, the 14-days BTC price volatility dropped to 31.58%, the lowest in 2020. Based on the history of BTC volatility, after a period of low volatility, the market is likely to experience strong volatility.

As volatility continues to decrease, the level of market activity has started to drop. In June, trading volumes in both the spot and derivative markets have plunged.

Disclaimer

Matrixport provides this analysis as general information only. Matrixport accepts no responsibility for the accuracy or completeness of any information herein contained and Matrixport shall not be responsible for any loss arising from any investment based on any forecast or other information herein contained. The contents of this materials should not be construed as an express or implied promise, guarantee or implication by Matrixport that the forecast information will eventuate. The cryptocurrency market is highly volatile. Buying, selling, holding, or investing in cryptocurrencies or related product carries various risks and is not suitable for all investors. Please seek expert advice, and always ensure that you fully understand these risks before participating in the cryptocurrency market. Matrixport is not acting as a financial adviser, consultant or fiduciary to you with respect to any information provided. Any information available here is “general” in nature and for informational purposes only.